M&A ADVISORY

Sell Side Advisory

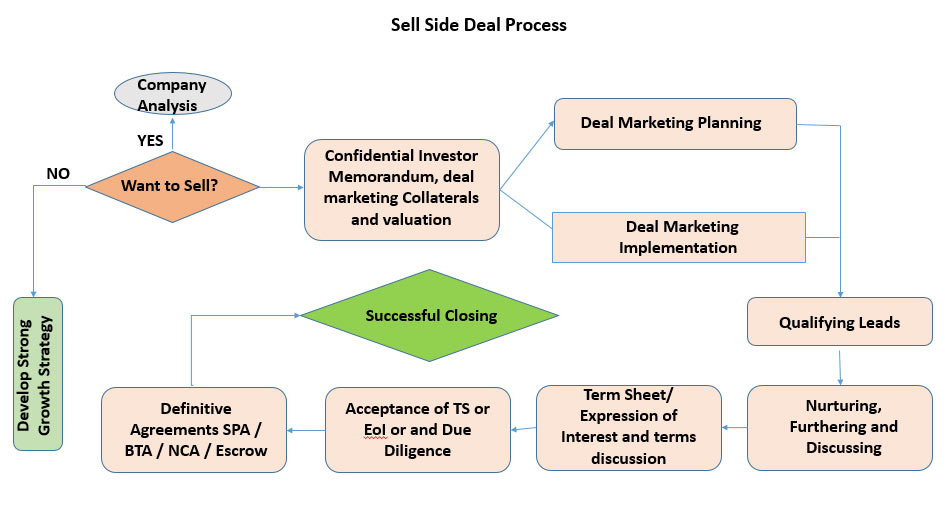

Business value created over a period may be required to be encashed due to variety of reasons such as lack of succession, pure exit to as part of strategy etc. We assist companies in realising their value. We find the right fit considering the issues involved, such as finding proper cultural fit, aspirations of the seller, structure of the company etc.We have a close relationship the company in the entire transaction life cycle – understanding the business, preparation of deal documents, enterprise valuation and setting up value expectation, deal scouting, keeping the company in due diligence readiness, negotiation, discussions on term sheet conditions, due diligence, final documentation, receipt of consideration and ultimate transfer. In all these, our accent is in providing minimalistic, yet workable solutions.

Buy Side Advisory

We work on buy side with companies to fulfil their inorganic growth aspirations. We provide optimal solutions to companies in finding newer projects, products, geographies and markets or simple acquisition of competitors. We assist the company with our effective and minimalistic approach in the entire life cycle, starting with scoping.Joint Venture or Technical Collaboration

One quick way to accelerate your business with adequate finance and technological superiority is to get a joint venture going. We scout and find the right match, meet with them and take it to logical closure.Generally, we have wide array of contact and we reach out to global market through our networked contacts. We reach out to the entire gamut of possibilities. Competitors, M&A teams in corporates and Private Equity Groups that acquire companies.

SERVICE OFFERING

Three Divisions.“SMB Enablers” the entity and Financial Solutions division. And you are here. “Golden Egg” harnesses forgotten wealth. An end-to-end service company that claims legacy shares in paper format or shares that have gone to IEPF. You may visit Golden Egg here. “Docskart” is a repository of business process documents. Excel Sheets, word documents, letters and power point etc. You may visit Docskart here. CMA data for bank funding can be generated in https://www.cma.docskart.com/

MANAGEMENT TEAM

Srikanth Gopalan

Srikanth Gopalan – Chartered Accountant cum Cost Accountant having over 28 years of experience. All his life Srikanth has been working in Mid-corps and he knows the pulse of SMEs and Mid-Corps better. SMB Enablers is the result of this experience and clear understanding of the needs of SMEs and Mid-Corps and their pain points to be addressed.

Good writer capable of writing articles, ebook and training material. Exercise is a chore, Srikanth rigorously follows. Controlled hypertensive, calm and rational. Strategy and planning are his strong points. Father of two, loves to listen to Carnatic music if work spares the time.

Suresh Jeganathan

Suresh Jeganathan – Seasoned Professional with 20+ years of experience Over 12 years of work experience in USA. Suresh worked in Whirlpool for 17 years in various leadership positions. Extensive experience in managing and implementing large Projects. Last role as Global Director of Whirlpool – Heading a Global Development Center.

Post his Whirpool tenure, he completed masters in psychology and is certified master practitioner of Neuro Linguistic Programming. Suresh has a twin role of driving “Enterprise Stress Management” and taking care of the entire operation including project management.

Process, control and fitness freak, controlled diabetic, father of two, analytical, data driven and successful.